Understanding Fund Accounting of Charities in Canada

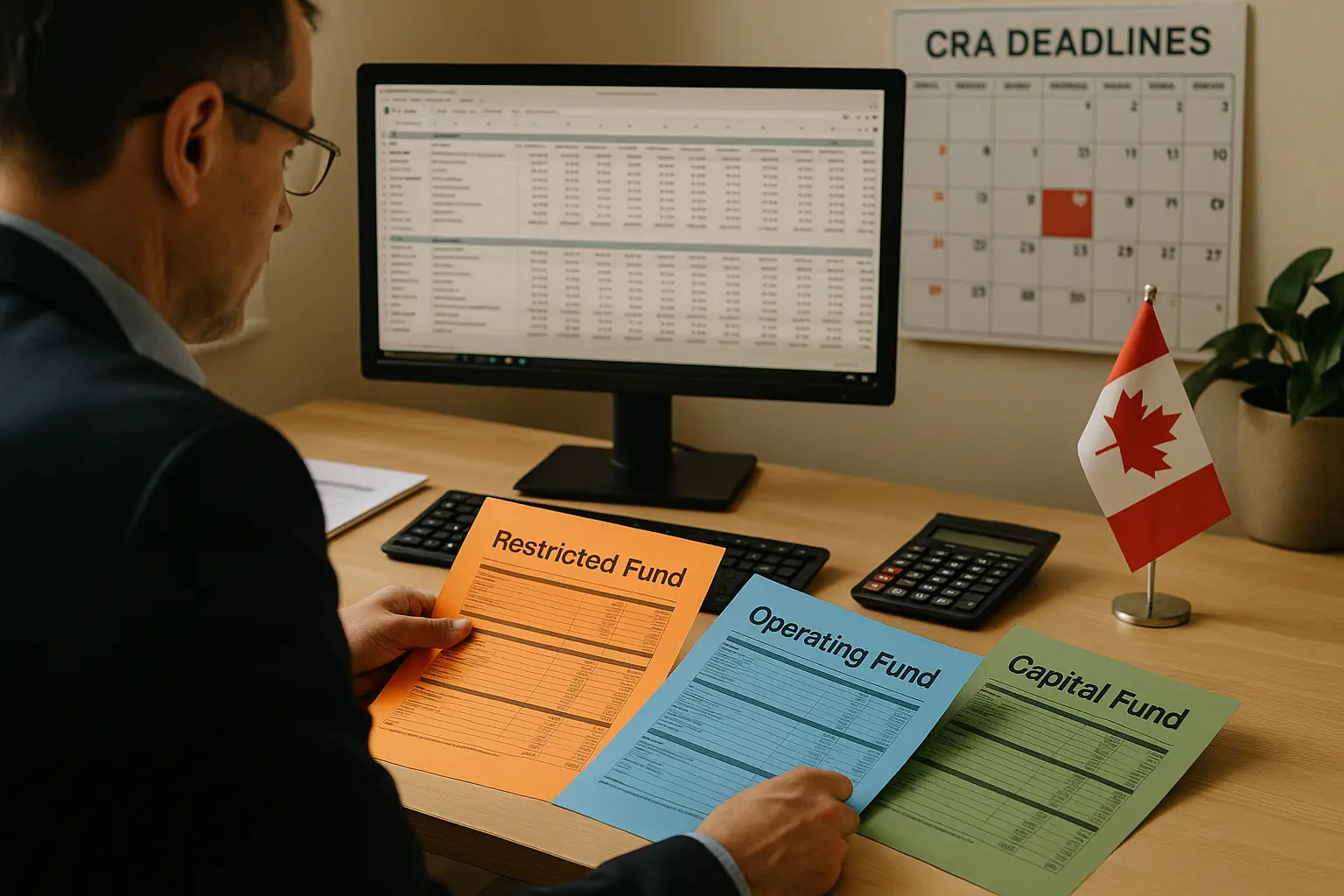

Fund accounting is a specialized system that separates a charity's finances into distinct categories or "funds." Each fund has its own purpose and restrictions. This system ensures proper tracking and compliance with donor requirements and regulatory obligations.

Canadian charities managing multiple funding sources with different restrictions need more than traditional accounting methods. This system becomes essential when organizations receive restricted grants, earmarked donations, or set aside funds for specific initiatives. Without proper fund accounting, charities risk misusing restricted funds and losing their charitable status.

This guide examines Canada Revenue Agency requirements, accounting standards for not-for-profit organizations, and practical implementation tools. Understanding these principles helps organizations maintain compliance while building trust with donors and communities they serve.

Fund Accounting Principles for Canadian Charities

Fund accounting forms the foundation for charity financial management in Canada. We separate money based on donor-imposed restrictions and internal policies.

This system ensures charities track unrestricted funds, restricted funds, and endowment funds according to specific rules that protect donor trust.

Purpose of Fund Accounting in Charities

Fund accounting helps Canadian charities manage different types of money separately. We use this system to track funds with specific rules about spending.

Accountability and Transparency This method shows donors and the public how we use their money. Each fund operates like its own account with balanced debits and credits.

Legal Compliance Canadian charities must follow strict rules about restricted funds. Fund accounting helps us prove we use money correctly according to donor wishes and government rules.

Financial Reporting We can create clear reports that show different fund categories. This makes it easier for board members, donors, and regulators to understand our financial health.

The system protects donor trust by ensuring restricted donations go only toward their intended purpose.

Key Elements of Fund Accounting

Fund accounting requires specific components that work together. We organize our finances using these essential elements.

Self-Balancing Accounts Each fund maintains its own set of accounts where debits equal credits. This creates a complete financial picture for every fund category.

Separate Record Keeping We track income, expenses, and assets separately for each fund. This prevents mixing restricted money with general operating funds.

Fund Transfers Sometimes we need to move money between funds following specific rules. These transfers must be properly documented and legally allowed.

Net Asset Classification We classify net assets based on restrictions rather than just total amounts. This shows what money is available for different purposes.

Types of Funds: Restricted, Unrestricted, and Endowment

Canadian charities typically manage three main fund types. Each type has different rules and purposes.

Unrestricted Funds These funds have no donor-imposed restrictions on their use. We can spend this money on any charity purpose including:

- General operations

- Administrative costs

- Program activities

- Emergency expenses

Restricted Funds Donors or government grants create specific spending rules for these funds. Common restrictions include:

- Purchasing specific items only

- Supporting particular programs

- Geographic limitations

- Time-based requirements

Endowment Funds These funds preserve the original donation amount permanently. We invest the principal and use only the investment income for charity work.

The principal amount stays intact while earnings support our mission over time.

Want to better understand fund accounting for charities in Canada? To learn more about restricted funds, check out our practical guide for nonprofits.

Legal and Regulatory Requirements

Canadian charities must follow strict legal rules when using fund accounting. The Canada Revenue Agency sets these rules through the Income Tax Act and requires specific reporting methods.

Charitable Registration and Status

We must register with the Canada Revenue Agency to operate as a charity in Canada. This registration gives us charitable status under the Income Tax Act.

The CRA reviews our application to make sure we meet all requirements. We need to show that our purpose helps the public and that we have proper governance structures. The CRA outlines the roles and responsibilities of directors and board members, which charities should follow to maintain good governance and accountability.

Once registered, we get a charity number. This number lets donors claim tax receipts for their gifts, and we must display it on all official documents.

Key requirements for registration:

- Clear charitable purpose

- Public benefit activities

- Proper board structure

- Financial accountability systems

We can lose our charitable status if we break the rules. The CRA can revoke registration for serious violations.

Regulations from the Canada Revenue Agency

The CRA sets specific rules for how we track and report our funds. We must keep detailed books and records for all financial activities. For more detailed guidance on acceptable fundraising practices and regulatory expectations, the CRA provides a comprehensive Fundraising Guidance for Registered Charities.

Required record-keeping includes:

- All donation receipts and records

- Bank statements and financial transactions

- Board meeting minutes

- Expense tracking by fund type

We must file our Annual Information Return (Form T3010) every year. This form shows how we used our funds during the fiscal year.

The CRA can audit our records at any time. During audits, they check if we properly separated restricted and unrestricted funds.

We must spend a minimum amount on charitable activities each year. The CRA calls this the "disbursement quota."

The Income Tax Act and Related Legislation

The Income Tax Act is the main law that governs Canadian charities. It defines what counts as a charitable organization and sets our legal duties.

The Act requires us to:

- Use funds only for charitable purposes

- Keep separate accounting for restricted donations

- File annual returns on time

- Maintain proper financial controls

Section 149.1 of the Act outlines the specific rules for registered charities. This section explains how we must handle different types of funds.

We must follow the disbursement quota rules under the Act. This means spending at least 3.5% of the first $1 million of our investment assets not used directly in charitable activities each year, and 5% on the portion of those assets exceeding $1 million. As of January 1, 2023, the CRA increased the disbursement quota rate for larger asset holdings to ensure charities deploy their resources more actively toward their charitable missions.

The Act also sets penalties for non-compliance. These can include fines, suspension of receipting privileges, or loss of charitable status.

Financial Reporting Obligations

Canadian charities must meet specific financial reporting requirements set by the Canada Revenue Agency and comply with accounting standards. These obligations include filing annual information returns and preparing detailed financial statements that show transparency and proper fund management.

Annual Information Returns (T3010 and Form T3010)

We must file Form T3010, the Registered Charity Information Return, with the CRA each year. This form is due within six months of our fiscal year-end.

The T3010 requires detailed information about our charity's activities, finances, and governance. We need to report total revenues, expenditures, assets, and liabilities.

Key sections include:

- Financial information from our audited statements

- Details about our charitable programs and activities

- Information about directors, trustees, and key staff

- The ten highest-paid permanent full-time employees (regardless of salary amount), with compensation details reported in specific salary brackets starting from $1 to $39,999, then $40,000 to $79,999, and so on

Missing the T3010 deadline can result in penalties or loss of charitable status. We must also make this return publicly available through the CRA's website.

The form helps the CRA monitor our compliance with charitable purposes and spending requirements.

Required Financial Statements

We must prepare annual financial statements that follow Canadian accounting standards. These statements provide a complete picture of our financial position and activities.

The four required statements are:

- Statement of Financial Position: Shows our assets, liabilities, and net assets at year-end

- Statement of Operations: Details revenues and expenses for the fiscal year

- Statement of Changes in Net Assets: Tracks changes in restricted and unrestricted funds

- Statement of Cash Flows: Reports cash receipts and payments during the year

Under the Canada Not-for-profit Corporations Act (CNCA), charities that are "soliciting corporations" (which includes most registered charities) must have an audit if annual revenue exceeds $250,000, unless members unanimously waive it (in which case a review engagement is required). If revenue exceeds $1,000,000, an audit is strictly mandatory with no waiver possible. Smaller organizations may prepare reviewed or compiled statements, though compilation engagements (Notice to Reader) may be insufficient for charities receiving significant public funding or those subject to stricter provincial requirements under acts like Ontario's Charities Accounting Act or Not-for-Profit Corporations Act (ONCA).

Financial Statement Presentation and Disclosures

Our financial statements must clearly separate restricted and unrestricted funds to show donors how we use their contributions. We present fund information in columns or separate statements.

Required disclosures include:

- Accounting policies we follow

- Details about significant investments

- Information about government grants and major donors

- Related party transactions

We must also include notes explaining our fund accounting practices and any restrictions on net assets. Tax receipts issued during the year should be properly documented and supported by our records.

The statements must show that we spend funds according to donor restrictions and charitable purposes.

Accounting Standards and Frameworks

Canadian charities must follow specific accounting standards that differ from for-profit businesses. The Accounting Standards for Not-for-Profit Organizations (ASNPO) provides the main framework. CPA Canada oversees implementation and guidance.

Overview of ASNPO for Charities

The Accounting Standards for Not-for-Profit Organizations (ASNPO) serves as the primary accounting framework for Canadian charities. We find this standard under Part III of the CPA Canada Handbook.

ASNPO focuses on accountability and transparency in financial reporting. This approach helps charities show donors and stakeholders how they use funds.

Key features of ASNPO include:

- Fund accounting requirements for restricted donations

- Revenue recognition rules specific to charitable giving

- Guidelines for reporting contributions and grants

- Standards for financial statement presentation

The framework requires charities to separate restricted and unrestricted funds clearly. We see this separation in financial statements through different fund categories.

ASNPO also addresses how charities should handle donated goods and volunteer services. These non-cash contributions need proper valuation and recording.

Role of CPA Canada and Other Regulatory Bodies

CPA Canada develops and maintains the ASNPO standards that govern charity accounting. We rely on their guidance for interpreting complex accounting situations.

The organization provides several resources for charities:

- Technical guidance documents on specific accounting issues

- Training materials for charity financial staff

- Updates on standard changes and new requirements

Canada Revenue Agency (CRA) also plays a key role in charity oversight. They require specific financial information in annual filings that must align with ASNPO standards.

Provincial regulators add another layer of requirements. Each province may have additional reporting rules for registered charities operating in their jurisdiction.

We often see coordination between these bodies to ensure consistent standards. This cooperation helps charities understand their obligations across different regulatory frameworks.

Financial Management and Internal Controls

Strong financial management requires proper budgeting, clear policies, and robust internal controls to protect charitable assets. These systems help Canadian charities maintain compliance and build donor trust through transparent operations.

Budgeting and Financial Policies

We must create detailed budgets that align with our charitable mission and fund restrictions. Annual budgets should separate restricted and unrestricted funds clearly.

Board-approved financial policies guide our daily operations. These policies cover spending limits, approval processes, and fund management rules.

Key Financial Policies Include:

- Expense approval thresholds

- Investment guidelines

- Reserve fund targets

- Donor stewardship procedures

We should review budgets monthly and compare actual results to projections. This helps us spot problems early and make necessary adjustments.

Financial policies must address how we handle different fund types. Restricted funds need separate tracking to ensure compliance with donor requirements.

Implementing Internal Controls

Internal controls protect our organization from fraud and errors.

We separate duties wherever possible to reduce risks.

Essential Control Areas:

- Cash handling: Different people collect, deposit, and record money.

- Cheque processing: One person authorizes, while another signs cheques.

- Bank reconciliation: An independent person reviews all accounts monthly.

We match daily deposits to bank statements and donation records.

Receipt books and our accounting system track all incoming funds.

Purchasing controls require written approval for expenses above set limits.

We add protection by requiring multiple signatures on large cheques.

We document all financial procedures clearly.

Staff training helps everyone understand their role in maintaining these controls.

Audits and Working with Auditors

Annual audits verify our financial statements independently.

We prepare by organizing records and resolving outstanding issues.

Auditors review our fund accounting and internal controls.

They check that we use restricted funds properly and keep accurate statements.

Audit Preparation Steps:

- Gather all financial records.

- Prepare fund reconciliations.

- Document internal control procedures.

- Review board meeting minutes.

We work with our auditors throughout the process.

Quick responses to requests help keep audit costs down and timelines on track.

The audit report supports our public accountability.

Clean audit opinions build donor and funder confidence.

Tools, Best Practices, and Emerging Topics

Canadian charities need reliable systems and current knowledge to manage fund accounting well.

Modern software, good record-keeping, and ongoing training form the foundation for strong financial management.

Effective Record-Keeping Practices

Strong record-keeping starts with organizing documents by fund type and purpose.

Create separate filing systems for restricted grants, unrestricted donations, and internally designated funds.

Digital storage works best for most organizations.

Scan receipts, grant agreements, and donor correspondence right away.

Use clear file names like "2025-Grant-HealthCanada-Invoice001."

Essential records to maintain:

- Donation receipts with tax numbers

- Grant agreements and reporting requirements

- Board resolutions for internal restrictions

- GST/HST documentation

- Monthly bank reconciliations

Track donor restrictions in a simple spreadsheet.

List each restricted fund, its purpose, and spending rules.

Update the document whenever you receive new restricted donations or grants.

Keep general books and records (ledgers, journals, financial statements) for at least six years from the end of the last tax year to which they relate. Duplicate donation receipts must be kept for two years from the end of the calendar year in which the donations were made. If a charity's registration is revoked, all records must be kept for two years after the date of revocation. The CRA requires these retention periods for compliance and potential audit purposes.

Accounting Software for Non-Profits

Specialized non-profit accounting software handles fund accounting better than general business programs.

These systems track multiple funds and generate required charity reports.

Popular options for Canadian charities:

- QuickBooks Non-profit: Good for smaller organizations, handles basic fund tracking.

- Sage Intacct: Advanced features for larger charities, strong reporting tools.

- Aplos: Designed for non-profits, includes donor management.

- Blackbaud Financial Edge NXT: Comprehensive for complex organizations.

Choose software that separates funds automatically.

The system should create different accounts for restricted and unrestricted money.

GST/HST tracking is crucial.

Select software that handles tax calculations for different revenue types.

Some donations are tax-exempt, but program fees may require GST/HST.

Cloud-based systems work well for charities.

Multiple staff can access records safely, and automatic backups protect against data loss.

Professional Development and Workshops

Non-profit accounting rules change often.

We need ongoing training to stay current with regulations and best practices.

The Chartered Professional Accountants of Canada offers workshops for charity accounting.

These sessions cover fund accounting, tax compliance, and reporting requirements.

Key training topics to prioritize:

- Annual regulatory changes

- Grant reporting requirements

- New accounting standards

- Technology updates

Local non-profit associations offer affordable workshops.

Many provinces have charity councils that provide training throughout the year.

Online courses offer flexible learning options.

The Canadian Association of Gift Planners provides webinars on donation processing and tax receipting.

Budget for training costs each year.

Well-trained staff make fewer errors and save money long-term.

Trends and Innovation in Charity Accounting

Automation is changing how we handle routine tasks.

Modern software can categorize donations and generate monthly reports automatically.

Artificial intelligence speeds up data entry.

Some programs read invoices and enter information directly into accounting systems.

This reduces errors and saves time.

Real-time reporting gives better financial control.

Board members can access current data anytime through secure dashboards.

Emerging technology trends:

- Mobile expense tracking apps

- Automated bank reconciliation

- Digital receipt processing

- Cloud-based collaboration tools

Data security is more important as we store information online.

Two-factor authentication and encrypted storage protect donor information.

System integration improves efficiency.

Donation management software now connects directly with accounting programs.

This eliminates duplicate data entry.

Grant management tools are more advanced now.

These systems track application deadlines, reporting, and spending for multiple grants.

Tax Considerations for Canadian Charities

Charities in Canada must issue proper donation receipts, manage GST/HST, and handle different funding sources.

Each area needs specific knowledge to stay compliant with Canada Revenue Agency rules.

Handling Donations and Issuing Tax Receipts

When we receive donations, we issue official receipts that meet CRA requirements.

These receipts let donors claim tax credits on their tax returns.

Receipt Requirements:

- Include our registered charity number

- Show the donation amount and date

- Include donor's name and address

- Display our organization's name and address

We issue receipts only for eligible gifts.

Cash donations and some property gifts qualify.

We cannot receipt payments for services, goods, or membership fees.

Non-cash donations need special attention. We must determine the fair market value (FMV) at the time of donation and be able to defend our valuation. While the CRA's "safe harbour" threshold recommends obtaining an independent professional appraisal for gifts-in-kind valued at $1,000 or more, this is not always a strict legal requirement for all items. However, charities must be prepared to justify the FMV of any non-cash gift. Different rules may apply if the gift involves advantaged arrangements or split-receipting, so careful evaluation is essential for each donation.

We keep detailed records of all donations. Duplicate donation receipts must be kept for two years from the end of the calendar year in which the donations were made. General books and records must be kept for six years from the end of the last tax year to which they relate. If our registration is revoked, all records must be kept for two years after the date of revocation.

GST/HST Compliance

Most charities can claim GST/HST rebates on eligible purchases.

We recover 50% of GST/HST paid on most goods and services used in our activities.

Rebate Process:

- File Form GST66 annually or quarterly, matching your reporting period

- Include supporting receipts and invoices

- Submit within four years of the purchase date

Some purchases qualify for higher rebates.

Books, medical equipment, and some building materials may get full rebates.

We register for GST/HST if our revenues exceed $50,000 a year.

Once registered, we collect GST/HST on taxable supplies and can claim full input tax credits.

Navigating Grants and Other Funding

Government grants usually do not generate taxable income for charities.

We track how we use restricted grant funds through proper fund accounting.

Grant Considerations:

- Most grants are tax-free if used for charitable purposes

- Business income from grants may be taxable

- We must meet specific reporting requirements

Corporate sponsorships may be taxable if we provide advertising or promotional benefits.

We distinguish between donations and business arrangements.

Investment income from endowment funds is usually tax-exempt.

We must spend a minimum amount each year on charitable activities based on our assets.

Disbursement Quota: As of January 1, 2023, we must spend at least 3.5% of the first $1 million of assets not used directly in charitable activities or administration, and 5% on the portion of those assets exceeding $1 million, each year. This tiered approach ensures larger charities deploy their resources more actively toward their charitable missions.

If we do not meet this quota, we may face penalties or lose charitable status.

Conclusion

Fund accounting serves as the foundation for effective charity management in Canada, helping organizations track restricted donations, meet legal requirements, and build donor trust. This system enables clear spending records and compliance with Canada Revenue Agency standards.

Key benefits include better financial tracking, regulatory compliance, improved donor confidence, and proper separation of restricted funds. Charities with proper fund accounting can focus on their mission while maintaining required transparency and accountability.

At Charity Accounting Firm, we help Canadian organizations implement compliant fund accounting systems. Book a free call to learn how we can support your charity's financial management needs.

Frequently Asked Questions

Fund accounting raises many questions for Canadian charities.

These questions cover basic concepts, reporting standards, audit requirements, examples, accounting methods, and the purpose of this system.

What are the basics of fund accounting?

Fund accounting separates money into categories based on restrictions. Each fund tracks its own income and expenses, with restricted funds having specific spending rules from donors, grants, or the board.

What is the accounting standard for charity?

Canadian charities follow the Accounting Standards for Not-for-Profit Organizations (ASNPO). These standards require a clear separation of restricted and unrestricted funds in financial statements.

Do charities need audited financial statements in Canada?

Audit requirements depend on the governing legislation and charity size. Under the Canada Not-for-profit Corporations Act (CNCA), soliciting corporations (most registered charities) must have audits if annual revenue exceeds $250,000, unless members unanimously waive it (requiring a review engagement instead). If revenue exceeds $1,000,000, an audit is strictly mandatory with no waiver possible. Check your provincial regulations for specific thresholds and requirements.

What is an example of fund accounting?

A food bank receives $50,000 in restricted government grants, $20,000 in general donations, and sets aside $10,000 for building repairs. Each creates a separate fund with its own tracking and reporting.

What are the methods of fund accounting?

Two primary methods: restricted fund method (creates separate funds) and deferral method (records as deferred revenue). Most Canadian charities use the restricted fund method for clearer tracking.

What is the primary purpose of fund accounting?

To ensure donations and grants are used for their intended purposes while maintaining compliance with donor agreements and regulations. It provides clear financial tracking and stakeholder transparency.